By David Milliken

LONDON (Reuters) – The Bank of England looks on course to raise its main interest rate by half a percentage point to 4% on Feb. 2, but economists will be looking keenly for signals that this 10th consecutive rate rise will be one of the BoE’s last.

The BoE was the first major economy central bank to begin tightening after the COVID-19 pandemic, lifting rates from a record-low 0.1% in December 2021.

But Britain’s inflation rate hit a 41-year high of 11.1% in October, driven in large part by Russia’s invasion of Ukraine. At 10.5% in December, inflation is further from its 2% target than equivalents in the United States or the euro zone.

Forecasts by economists polled by Reuters and pricing in financial markets point towards the BoE raising rates by another half point to 4% on Feb. 2, the highest since 2008, though there is a risk of a smaller increase to 3.75%.

After that, most economists see just one rate rise more – to 4.25% in March – while financial markets price in the tightening cycle ending in the middle of this year at 4.5%.

“We will be closely watching for signals that the Committee is getting closer to the end of the hiking cycle,” UBS economist Anna Titareva wrote in a note to clients on Thursday.

The U.S. Federal Reserve – which also meets next week – is similarly expected to end its tightening cycle soon while the European Central Bank is seen further away from reaching the limit of its rate hikes.

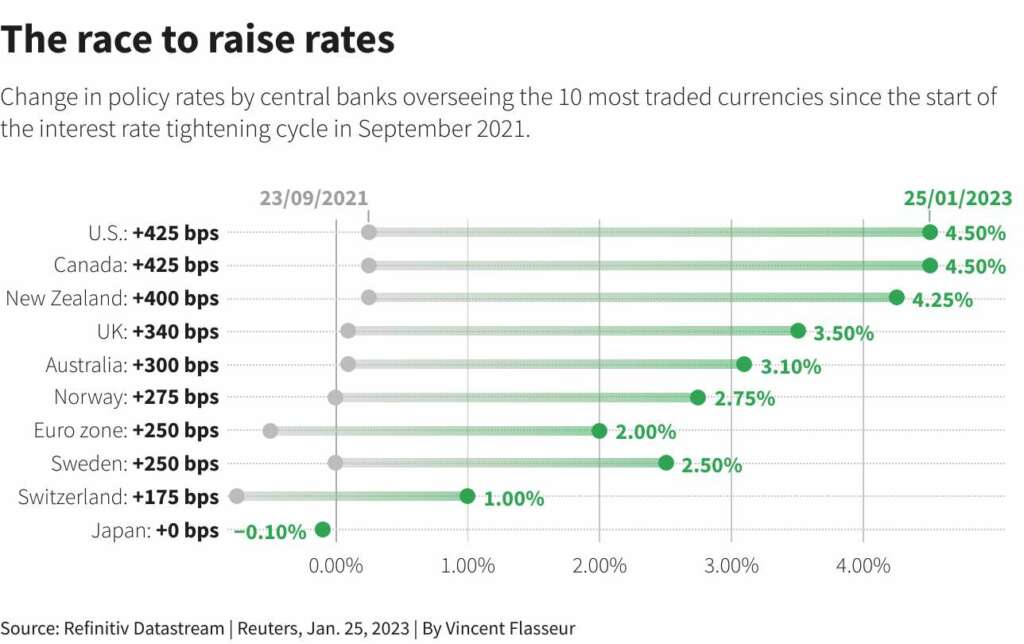

GRAPHIC: The race to raise rates – https://www.reuters.com/graphics/CANADA-CENBANK/myvmogegbvr/chart.png

SPLIT COMMITTEE

The Monetary Policy Committee (MPC) split three ways in December when it backed a 50 basis-point increase. Two members – Silvana Tenreyro and Swati Dhingra – voted to end the rate rises while Catherine Mann backed a larger three-quarter-point move.

Economists see a similar split next week, reflecting uncertainty about how fast inflation will fall in 2023 and 2024, and whether it risks bottoming out above the BoE’s 2% target.

Natural gas prices are lower than they were a year ago and are significantly below the BoE’s assumptions used in its last forecasts in early November.

Governor Andrew Bailey said there was “more optimism” that inflation would fall swiftly.

Economists expect the BoE to trim its forecast for end-2023 inflation to 3-4% from over 5% in November.

Also pushing down on inflation is a weak economic outlook – even if it seems to have avoided a recession in the second half of 2022 – and much of the effect of the BoE’s rate rises so far is yet to be felt.

About 2.7 million homeowners with short-term fixed-rate mortgages will pay at least 100 pounds ($124) a month more after they refinance at higher rates this year, the BoE predicts.

LABOUR PRESSURES

However, BoE Chief Economist Huw Pill has warned that inflation is not guaranteed to return to target without further rate rises.

Pill saw some signs of softening in the labour market, but wages excluding bonuses rose at their fastest rate since records began in 2001 during the three months to November, excluding the period affected by government pandemic support measures.

The annual increase of 6.4% was roughly double the pace before the pandemic when inflation hovered around 2%.

Core inflation – which strips out changes in volatile food and energy prices – did not fall in December, while inflation for services was the strongest since 1992, both factors suggesting businesses are seeking to rebuild profit margins.

The BoE has also flagged how post-Brexit rules which came into effect two years ago have made Britain’s economy less efficient, shielding some firms from competition and making it harder to hire European Union migrants to fill low-paid roles.

Economists expect the BoE to be wary about signalling directly that it is almost done with rate rises – though it may tone down language on the likelihood of future “forceful” rate rises of half a point or more.

“The MPC will likely maintain its risk-averse approach,” said Andrew Goodwin of consultancy Oxford Economics.

($1 = 0.8067 pounds)

(Reporting by David Milliken; Editing by Nick Macfie)