By Marc Jones

LONDON (Reuters) – Analysts at Barclays have warned of a 5 percentage point hit to euro zone GDP and a dive below dollar parity for the euro if Russia closes its gas taps as part of the escalating war in Ukraine.

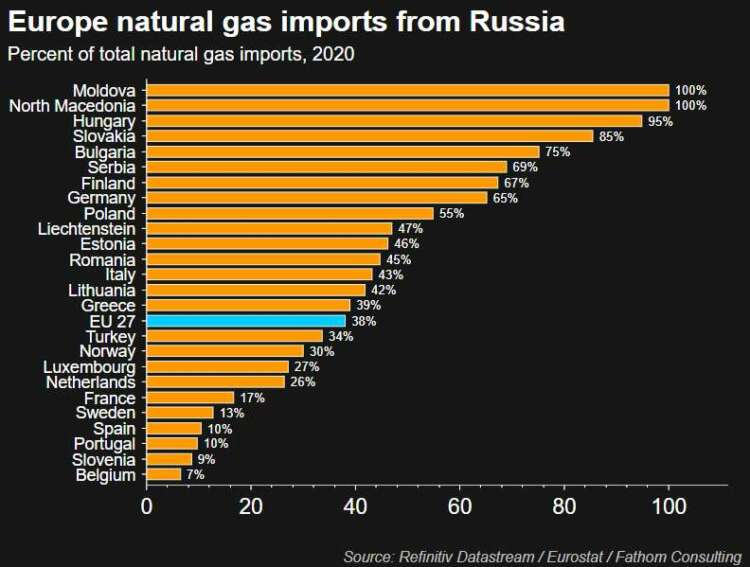

Worries are mounting in Europe that Moscow could sharply reduce the amount of gas it supplies or even stop it altogether as tensions rise and sanctions intensify over its assault on Ukraine.

The Kremlin has already cut off supplies to Bulgaria and Poland and this week sanctioned Gazprom’s European subsidiaries including Gazprom Germania, prompting Germany’s Economy Minister Robert Habeck to warn of no more gas from Russia.

“If Russia closes its gas taps (to Europe), we expect EURUSD to fall below parity,” Barclays said in a note on the rising tensions.

The euro is now at $1.03, having slumped around 8% in the last three months.

“Our economists estimate that a total loss of Russian supplies, combined with rationing of the remainder, could dent euro area GDP by more than 5 percentage points over one year”.

Pressure is now on Europe to secure alternative gas supplies well before the winter sees temperatures drop again.

The EU is currently grappling with Russia’s demand that countries start paying for their gas in roubles rather than euros or dollars as they traditionally have.

Bowing to such a demand could mean countries effectively breach their own sanctions brought against Russia as part of a co-ordinated move by the West to punish Moscow for its “special military operation” in Ukraine.

A recent report by credit ratings giant Moody’s warned that a halt to the energy trade between Russia and Europe would lead to recessions around the world

About 25% of the nearly 4,000 non-financial companies Moody’s analyses globally would “face significant stress” it said, although it would be a significantly higher 40% in the Europe Middle East and Africa (EMEA) region.

It “will cause significant stress around the world” Moody’s said.

(Reporting by Marc Jones; editing by Dhara Ranasinghe and Kim Coghill)