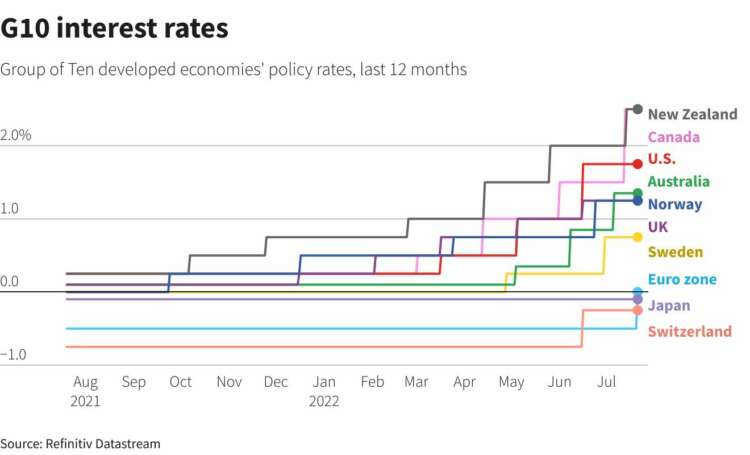

(Reuters) – The European Central Bank on Thursday delivered its first interest rate hike in over a decade, joining other major central banks in the race to get on top of surging inflation.

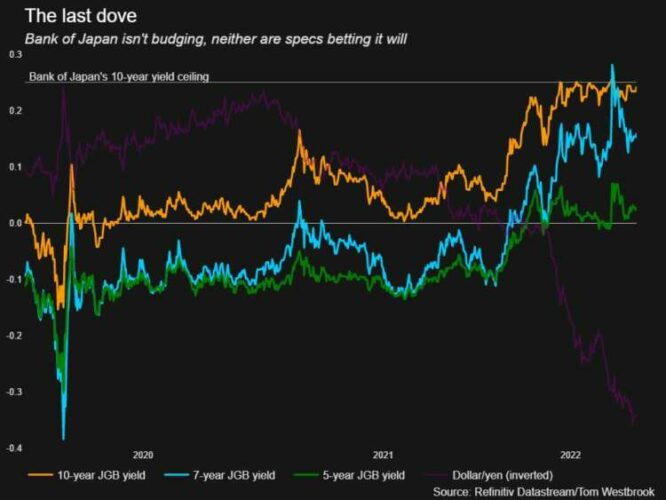

The United States, Canada, New Zealand and Switzerland among others have lined up in recent weeks with aggressive rate rises. Japan, which is yet to lift rates in this cycle, is left as the holdout dove among the 10 big developed economies.

In total, those central banks have so far raised rates in this cycle by a combined 1,140 basis points.

Graphic: G10 interest rates- https://graphics.reuters.com/EUROZONE-MARKETS/ECB/lbpgnemjqvq/chart.png

Here’s a look at where policymakers stand in the race to contain inflation.

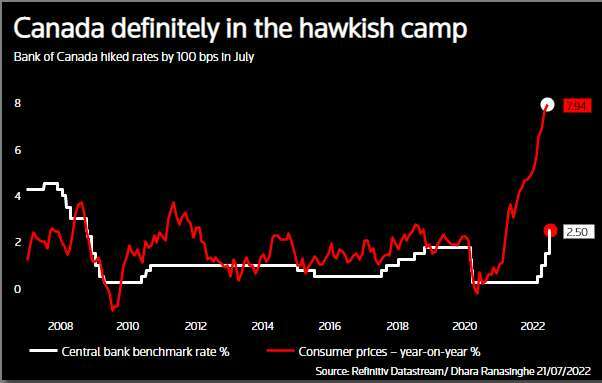

1) CANADA

The Bank of Canada is the chief hawk after last week delivering the first 100-basis-point rate increase — lifting its key policy rate to 1.5% — among the world’s advanced economies in the current policy-tightening cycle.

With data on Wednesday showing annual inflation at 8.1% in June, the highest in 39 years, analysts reckon another big rate hike is likely.

Graphic: Canada in the hawkish camp- https://fingfx.thomsonreuters.com/gfx/mkt/zdpxobjywvx/CA2107.PNG

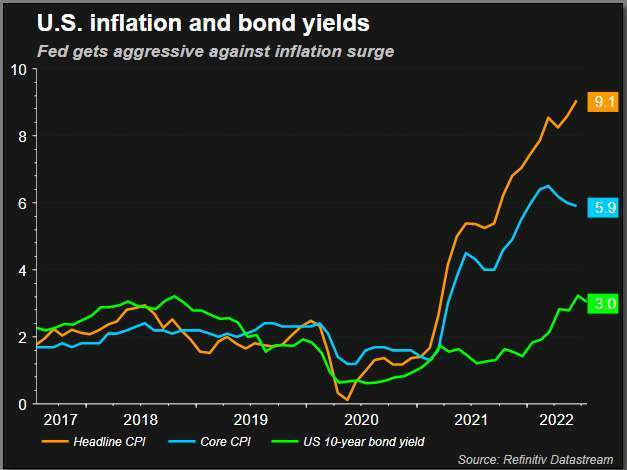

2) UNITED STATES

The Federal Reserve is not far behind. It’s widely expected to deliver its second 75 bps rate rise next week.

Data last week showed U.S. consumer prices accelerated 9.1% in June, the largest annual increase in inflation in more than 40 years. That sparked some excitement in markets over a 100 bps July rate move, but Fed officials doused that talk.

Graphic: U.S. inflation still at lofty levels–https://fingfx.thomsonreuters.com/gfx/mkt/jnpwedkgnpw/US2107PNG.PNG

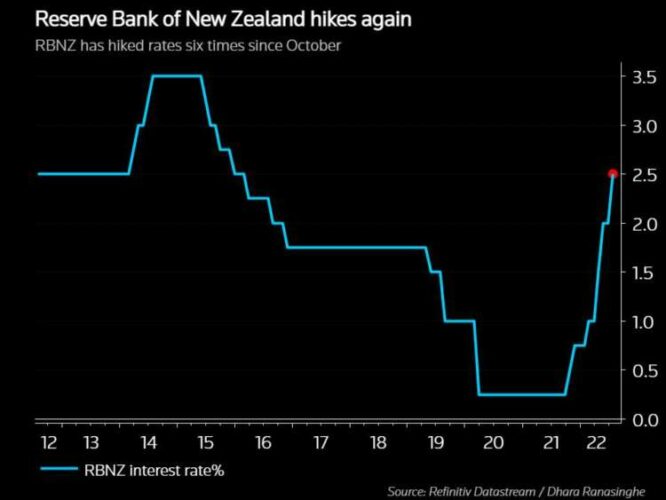

3) NEW ZEALAND

The Reserve Bank of New Zealand delivered its sixth straight rate rise last week, lifting the official cash rate by 50 bps to 2.5%, a level not seen since March 2016.

It remains comfortable with its planned aggressive tightening path to restrain runaway inflation.

Graphic: Reserve Bank of New Zealand gets aggressive- https://fingfx.thomsonreuters.com/gfx/mkt/lgvdwzlddpo/Pasted%20image%201657727974842.png

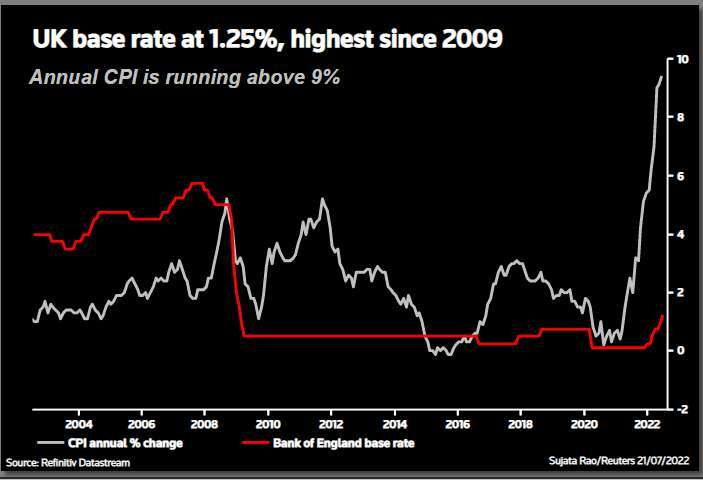

4) BRITAIN

The Bank of England will almost certainly hike rates for a sixth time in August following data showing inflation in June surged to a 40-year-high of 9.4%.

Investors are pricing in an almost 100% chance of the BoE raising the Bank Rate to 1.75% from 1.25%. The BoE said in June that it was ready to act “forcefully” if needed.

Graphic: UK inflation running above 9%- https://fingfx.thomsonreuters.com/gfx/mkt/lbpgnemnnvq/GB2107.PNG

5) NORWAY

Norway, the first big developed economy to kick off a rate-hiking cycle last year, raised rates by 50 bps on June 23 to 1.25%, its largest single hike since 2002.

The Norges Bank plans to raise rates by 25 bps at each of its four remaining policy meetings in 2022, although larger increments are also possible, Governor Ida Wolden Bache said.

6) AUSTRALIA

The Reserve Bank of Australia has raised its key rate three months in a row to 1.35% and markets are betting the rate will hit 3.5% by the end of 2022.

RBA Governor Philip Lowe on Wednesday indicated a steady drum beat of rate rises to stop a damaging inflationary cycle developing, and suggested rates could at least double from their current low levels.

7) SWEDEN

Another late-comer to the inflation battle, Sweden’s Riksbank delivered a half percentage-point interest rate hike on June 30 to 0.75%, its biggest hike in more than 20 years.

As recently as February, the Riksbank had forecast unchanged policy until 2024, but governor Stefan Ingves now expects rates to hit 2% in early 2023 and said 75 bps moves are possible.

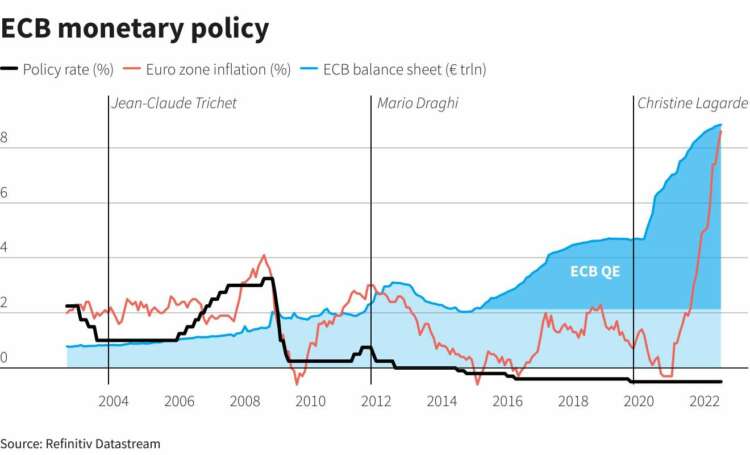

8) EURO ZONE

The European Central Bank on Thursday hiked its deposit rate by 50 bps — more than expected — in its first rate rise since 2011 as it fights soaring inflation. The move to raise rates to 0% brought an end to eight years of experimenting with negative rates.

The bank also promised further rate hikes possibly as soon as its next meeting on Sept. 8.

Graphic: ECB monetary policy- https://graphics.reuters.com/EUROZONE-MARKETS/ECB/zdpxobnwrvx/chart.png

9) SWITZERLAND

On June 16, the Swiss National Bank (SNB) unexpectedly raised its -0.75% interest rate, the world’s lowest, by 50 bps, sending the franc soaring.

Recent franc weakness has contributed to driving Swiss inflation towards 14-year highs and SNB governor Thomas Jordan said he no longer saw the franc as highly valued. That has opened the door to more rate hikes.

10) JAPAN

Japan is the holdout dove. On Thursday the Bank of Japan maintained ultra-low interest rates of -0.1% and signalled its resolve to keep them that way even as it projected inflation would exceed its target this year.

BOJ Governor Haruhiko Kuroda said he had no plan to raise rates or hike an implicit 0.25% cap set for the bank’s 10-year bond yield target, because Japan was still recovering from the pandemic and its terms of trade had worsened.

Graphic: BOJ is the last dove standing- https://fingfx.thomsonreuters.com/gfx/mkt/klvykrzggvg/Pasted%20image%201655441669556.png

(Reporting by Sujata Rao, Dhara Ranasinghe and Yoruk Bahceli, Tommy Reggiori Wilkes and Saikat Chatterjee and Vincent Flasseur; Editing by Toby Chopra and Hugh Lawson)