By Nupur Anand, Andrea Shalal and Balazs Koranyi

(Reuters) – U.S. authorities are set to explore ways to bolster financial stability, along with steps to tackle the problems facing First Republic Bank, as central banks assess whether turmoil in banking makes interest rate rises less pressing.

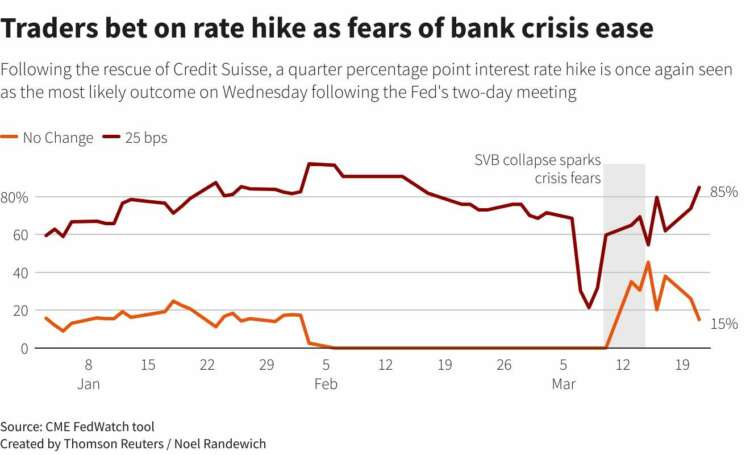

With an easing of recent big swings, Wednesday’s Federal Reserve meeting is firmly in focus, with traders split over whether the U.S. central bank will be forced to pause its hiking cycle as efforts continue to stabilise battered banking stocks.

Pacific Western Bank, one of the regional lenders caught up in the market volatility, said on Wednesday it had raised $1.4 billion from investment firm Atlas SP Partners.

Shares of the bank, which have lost nearly 47% of their value so far this year, fell about 9% in early trading even as it tried to assuage investor worries by saying it had more than $11.4 billion in cash as of March 20.

The Fed, whose relentless rate hikes to rein in inflation are among factors blamed for the biggest banking sector meltdown since the 2008 financial crisis, is tipped to raise rates by 25 basis points, half the 50 bps move foreseen before the shake-up.

“In order to solve the banking problem, you really have to go back down to very low interest rates and I don’t think that’s going to happen,” said Paul Nolte, senior wealth adviser and market strategist at Murphy & Sylvest.

“What you’re going to wind up with is a Fed that will probably be a little bit more focused on inflation and they’re going to deal with the banking situation as it comes up.”

European Central Bank top brass said on Wednesday they will watch for signs of stress in bank lending, a day after the ECB warned banks not to be caught off-guard by rising rates.

Investors are wondering whether the ECB will be able to continue hiking to fight inflation, but its chief economist Philip Lane said market jitters may turn out to be “a non-event” for monetary policy, while a full-blown crisis that completely rewrites the outlook is unlikely.

Speaking before Lane, ECB President Christine Lagarde said the ECB’s interest rate hikes could be magnified if banks become more risk-averse and start demanding higher rates when lending – implying the central bank may need to do less.

But an unexpected jump in UK inflation last month led investors to bet heavily that the Bank of England will raise interest rates by at least another 25 bps on Thursday.

And less than two weeks after Silicon Valley Bank (SVB) sank under the weight of bond-related losses due to surging interest rates, the CEO of hedge fund Man Group, Luke Ellis, said the turmoil was not over and predicted further bank failures.

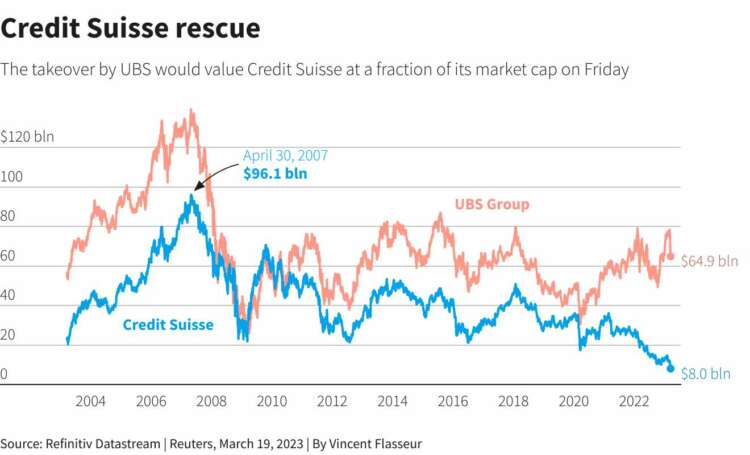

SVB’s collapse kicked off a tumultuous 10 days for banks which led to the 3 billion Swiss franc ($3.2 billion) Swiss engineered takeover of Credit Suisse by rival UBS.

While that deal brought some respite to battered banking stocks, U.S. lender First Republic remains firmly in the spotlight. It is looking at ways to shrink if it cannot raise new capital, three people familiar with the matter said.

First Republic’s volatile shares were up 3% in early trades.

Scenarios for the bank were being discussed as major bank CEOs gathered in Washington for a scheduled two-day meeting starting Tuesday, sources familiar with the matter said.

Graphic: Traders bet on rate hike as fears of bank crisis ease https://www.reuters.com/graphics/USA-RATES/FEDWATCH/xmpjkbnxmvr/chart.png

‘HEAD IN SAND’

The wipeout of Credit Suisse’s Additional Tier-1 (AT1) bondholders has sent shockwaves through bank debt markets.

But one of the largest investors in the Credit Suisse bonds said he still believes in the value of contingent convertible debt, known as CoCos, and the “bail-in” system meant to save banks seen as too big to fail.

“Anybody that bought CoCos who didn’t think ‘bailed-in’ had their head in the sand. Nobody likes it when it happens, but that’s the whole idea behind CoCos,” Philip Jacoby, chief investment officer at Spectrum Asset Management Inc, said.

UBS said on Wednesday it would buy back 2.75 billion euros ($2.96 billion) worth of debt it issued less than week ago, seeking to boost confidence among investors rattled by its $3 billion rescue of rival Credit Suisse at the weekend.

“They’re trying to be friendly to investors who purchased just before the mess,” said Jerome Legras, head of research at Axiom Alternative Investments.

For now, the Swiss bank rescue appears to have assuaged the worst fears of systemic contagion, boosting shares of European banks and U.S. lenders.

Policymakers from Washington to Tokyo have stressed the turmoil is different from the crisis 15 years ago, saying banks are better capitalised and funds more easily available.

After Treasury Secretary Janet Yellen said on Tuesday that the U.S. banking system was sound despite recent pressure, Deputy Treasury Secretary Wally Adeyemo said a review of the failures of SVB and Signature Bank was in order.

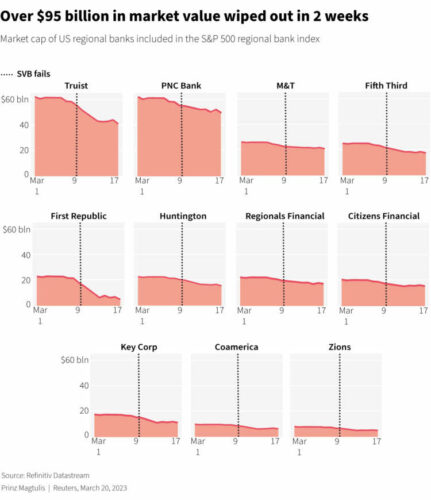

Graphic: Over $95 billion in market value wiped out in 2 weeks https://www.reuters.com/graphics/GLOBAL-BANKS/USA/myvmobkeovr/graphic.jpg

POST-MORTEM

“We of course continue to monitor the current situation and consider what steps can be taken to further strengthen America’s financial stability,” Adeyemo said at an event hosted by the U.S. Hispanic Chamber of Commerce, without elaborating.

Political pressure continues to grow in the United States to hold bank executives accountable. The Senate Banking Committee’s chairman said it will hold the “first of several hearings” on the collapse of SVB and Signature Bank on March 28.

Although the Fed has said its review of SVB’s supervision will be finished by May 1 and released to the public, recent banking system ructions are likely to feature prominently in its chief Jerome Powell’s post-meeting news briefing.

Graphic: Credit Suisse rescue https://www.reuters.com/graphics/GLOBAL-BANKS/myvmobgwyvr/chart.png

($1 = 0.9280 Swiss franc)

(Additional reporting by Sumeet Chaterjee, Tatiana Bautzer, Saeed Azhar, Scott Murdoch, Tom Westbrook, Shubham Batra, Amruta Khandekar, Ankika Biswas, Noel Randewich, Balazs Koranyi and Francesco Canepa, Akriti Sharma, Amanda Cooper: Writing by Lincoln Feast and Alexander Smith; Editing by Sam Holmes and Catherine Evans)