LONDON/SINGAPORE (Reuters) – An uneasy calm descended across battered bank bonds and shares on Tuesday, with prices recovering a day after regulators sought to convince investors that the hit facing bondholders of embattled Credit Suisse is isolated.

Additional Tier 1 (AT1) bonds issued by European lenders rose, with UniCredit’s 6.625% issue up more than 5 cents.

AT1 bonds from others such as Deutsche Bank, UBS and BNP Paribas rose more than 3 cents, data from MarketAxess and Tradeweb showed.

On Monday bank AT1 bonds took a beating after news that those issued by Credit Suisse would be written down to zero as part of a rescue merger with UBS.

Banking supervisors in Britain and the euro zone then tried to stop a market rout by stressing holders of such junior bank debt would only suffer losses after shareholders had been wiped out.

The European Central Bank’s top supervisor Andrea Enria said on Tuesday European Union authorities would never write off bank bonds before shares were wiped out, whether a bank is being wound down or there are “private solutions” to rescue it.

Tuesday’s AT1 rebound only partially offset hefty losses of 5 cents or more suffered on Monday and sentiment remained fragile.

“Looking forward, the bank debt market is likely to remain fragile as well as vulnerable for news headlines,” said Joost Beaumont, head of bank research at ABN AMRO.

AT1s are issued by banks to help them make up regulatory capital buffers.

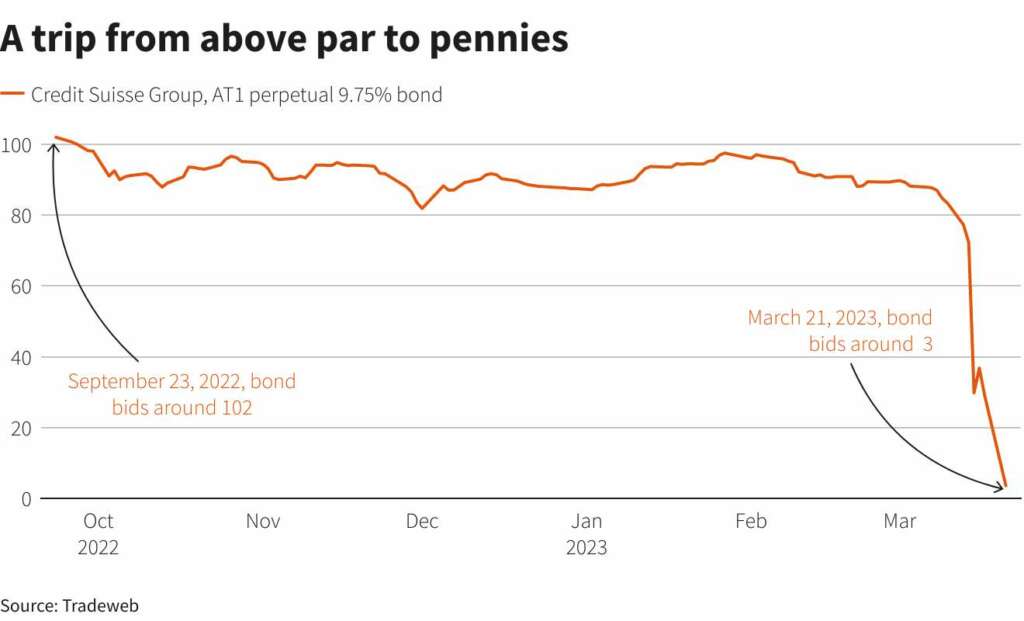

Credit Suisse’s own AT1 bonds were trading with bid prices around 3 cents on the dollar and ask prices around 6, according to Tradeweb, suggesting expectations bondholders may be able to recover some value. Some bondholders are mulling possible legal action after their wipeout, one law firm said on Monday.

Graphic: A trip from above par to pennies – https://www.reuters.com/graphics/GLOBAL-HEDGEFUNDS/jnpwyjaoxpw/chart.png

STABILITY?

European banking stocks rose 3.8%, set for their biggest one-day gain since October, U.S. bank stocks rallied 3.8%..

The cost of insuring exposure to bank debt meanwhile fell.

UBS five-year credit default swaps (CDS) fell 36 bps to 128 bps from Monday’s close, while Credit Suisse CDS also edged down, S&P Global Market Intelligence data showed.

The iTraxx Crossover Europe, which measures the cost of insuring exposure to a basket of European corporate junk debt, eased 31 basis points (bps) to 474 bps from Monday’s close, the S&P data showed. The iTraxx subordinated financials index tumbled by 22 bps to 195 bps, and the iTraxx senior financials index was down 11 bps to 106 bps.

Invesco’s AT1 Capital Bond exchange-traded fund, which tracks the value of AT1 debt, was flat having jumped over 2.5% earlier in the session and dropping sharply on Monday.

S&P Global Ratings said it did not believe the decision to write off Credit Suisse AT1s would lead to material contagion risk for European banks.

“Traders will wait to see a bit more stability before they add more money to these (bank) stocks. A lot of people just want to make sure that the contagion fears abate before jumping back in,” said Patrick Spencer, vice chair of equities at RW Baird.

Some investors took comfort from the distinction between rules governing AT1 bonds in Switzerland and other jurisdictions.

“You can’t apply the Credit Suisse story to any other bank because none of these other instruments have got the same sort of provision and the regulators now have come out globally saying hey, as far as we’re concerned, equity is first in line,” said Thomas Jacquot, head of research at fixed income broker FIIG in Sydney.

(Reporting by Tom Westbrook and Rae Wee in Singapore, and Chiara Elisei and Karin Strochecker in London; additonal reporting by Naomi Rovnick, Yoruk Bahceli and Francesco Canepa; Graphic by Nell Mackenzie; Writing by Dhara Ranasinghe, Editing by Jason Neely)