LONDON (Reuters) – Windfall taxes mean oil and gas producers in the British North Sea will likely leave 500 million barrels of oil equivalent in the ground over the next decade, the equivalent of one year’s output in the ageing basin, industry group OEUK said on Tuesday.

Over the past year, Britain has introduced windfall taxes on oil and gas as well as on renewables, which companies say stifles investment and in turn will likely increase Britain’s dependence on imported fuels and derail its climate targets.

In the oil and gas sector, the taxes are likely to result in reduced investment of between 3 billion to 5 billion pounds ($3.67 billion to $6.12 billion) over the next decade or so, Offshore Energies UK (OEUK) market intelligence manager Ross Dornan told reporters.

This reduction in investment is expected despite a tax incentive of around 91 pence per pound spent on new hydrocarbon production, which renewables producers are also calling for in their sector.

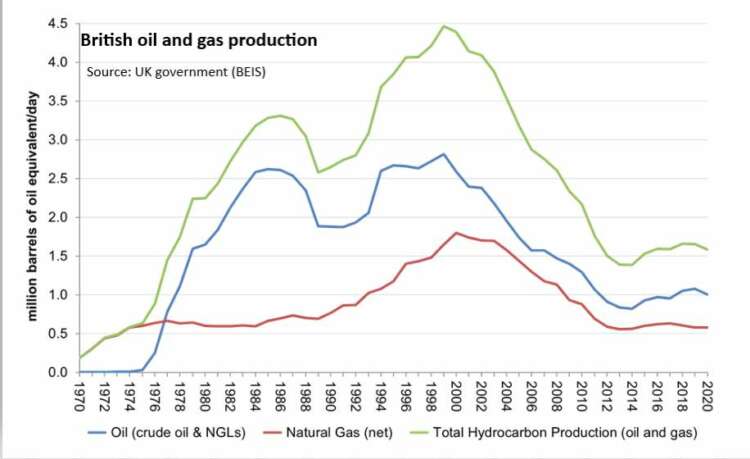

The British North Sea produced just under 1.4 million barrels of oil equivalent per day (boed) last year, down from a peak of around 4.4 million boed in 1999.

“When we talk about investment in the UK oil and gas resources, it’s not about exponential growth, it’s about managed decline,” Dornan said.

Britain, a net energy importer since 2004 whose energy mix last year was made up of 76% oil and gas, will likely produce 500 million barrels less hydrocarbons – “enough to support the nation for six months or (the) same as one year’s North Sea output” – due to investment cuts, according to the OEUK.

The report came as Britain’s government is set to announce energy security measures on Thursday, according to industry sources, which could see changes to taxes and investment incentives for the offshore industry.

Any fresh incentives for oil producers are likely to be decried by climate activists, not least since Britain experienced an oil leak over the weekend at Anglo-French oil company Wytch Farm’s onshore field in Dorset.

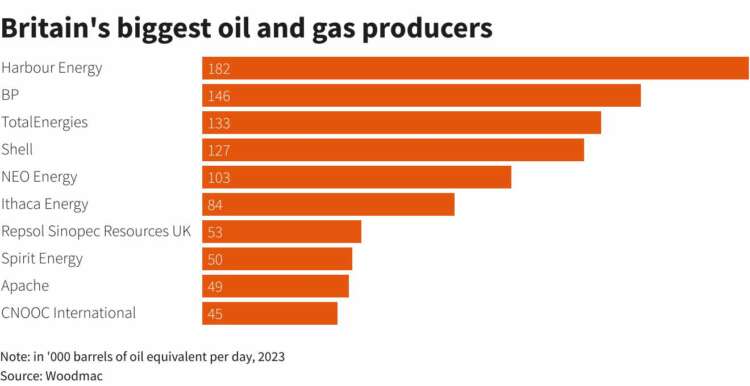

Britain’s biggest oil and gas producer, Harbour, has announced job cuts and shunned the latest licensing round. TotalEnergies cut its UK investment programme by a quarter.

Development of what would be the world’s largest wind farm off the coast of Britain is in doubt, with Orsted saying it needs more support to proceed with the project.

GRAPHIC: Britain’s biggest oil and gas producers https://www.reuters.com/graphics/BRITAIN-OIL/zdvxowamwpx/chart.png

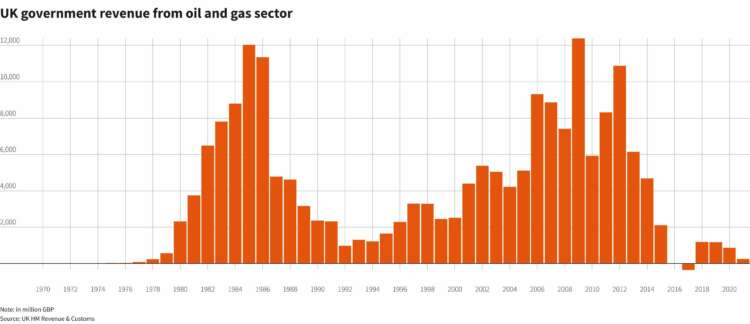

GRAPHIC: UK government revenue from oil and gas sector https://www.reuters.com/graphics/BRITAIN-OIL/TAX/akpezrnzavr/chart.png

GRAPHIC: Britain’s oil and gas production https://fingfx.thomsonreuters.com/gfx/ce/byprjzeljpe/Britain’s%20oil%20and%20gas%20production.png

($1 = 0.8166 pounds)

(Reporting by Shadia Nasralla; Editing by Sharon Singleton)